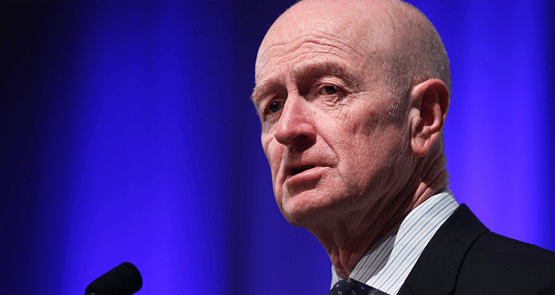

The sayings of the Guv. Only seven months (this week) to go before Reserve Bank governor Glenn Stevens steps off the stage that’s central banking and retires. He took up the post on September 18, 2006, and his last day is September 17 — unless the government asks him to stay for another term, which seems unlikely at this stage with a top-notch replacement ready to replace him in his deputy Phil Lowe. That means only one more appearance before the House of Reps’ economic committee, which he did last Friday for two and a half hours. Due to the exigencies of modern media and reporting — too little time, especially on a Friday afternoon and too little space to report his comments, the Guv did get headlines for comments on tax, the markets and banking, but there was more. For example, on the volatile start to 2016 with markets dropping, plunging, soaring and fretting, Stevens said:

“I think what we are seeing in global markets at present is markets are dropping their bundle.”

What a great way to dismiss much of the recent hype and rubbish from banks and analysts such as those at the Royal Bank of Scotland who told us to ”sell everything” and the Societe Generale “perma bear” global strategist Albert Edwards, who opined in January that the S&P 500 index could drop 65% to 550. “Dropping their bundle” indeed. Stevens also produced the most interesting answer of the morning when asked by an economics student from a Sydney college if the RBA could be forced to use monetary policy to prop up the dollar if its depreciation went too far:

“The level of the exchange rate and its effect on the economy is certainly something that we have to take into account when setting monetary policy. I am a bit cautious, though, about the idea that we would try to configure the interest rates specifically to just affect the currency. The history when countries have sought to do that is not always happy. In fact, it is, more often than not, an unhappy one. So the exchange rate matters — it is taken into account — but we do not try to directly target it with the interest rate.”

A lot of economists, media and others will be surprised at that comment because some of them have written erudite reports or stories claiming, at times, the RBA is doing just that. — Glenn Dyer

The dollar matters, but … As the Guv pointed out, the exchange rate “matters”, but it doesn’t drive monetary policy, hence the vaguely worded statements from Stevens at times, especially after RBA monetary policy meetings. And on the recent rise in bank funding costs (referred to in recent bank reports and no doubt by the NAB and ANZ in their trading updates this week) and whether that could produce a rise in mortgage rates, Stevens was not very convinced. “I do not see much of a case for independent increases in lending rates based on funding costs as they have evolved just lately. Of course, things may change as we go forward, but that is my take right now”.

And on the RBA’s easing bias, the Guv explained:

“It is, I think, pretty unlikely we are going to be raising rates any time soon. The question will be should we sit or go down some more, and that has been the question for some years now. So, yes, if that is what we mean by biased to ease, then, yes, that is a correct understanding.”

— Glenn Dyer

Jobs, jobs, everywhere … But despite that bias the Aussie dollar has been remarkably steady in the face of all the turmoil and nervousness on global markets. And there was the greatest mystery of them all at the moment about all matters economic: the jobs market.

“I think it is hard to ignore the conclusion that we have had more jobs growth and lower unemployment than we thought. So in some expenditure components somewhere — I am not quite sure where — there is economic activity happening and demand occurring and, so far anyway, it did not require the pick-up in non-mining investment. I admit I am a bit surprised that that is the outcome, but I think it is pleasing that we have had that outcome … I think it is hard to ignore the conclusion that we have had more jobs growth and lower unemployment than we thought. So in some expenditure components somewhere — I am not quite sure where –there is economic activity happening and demand occurring and, so far anyway, it did not require the pick-up in non-mining investment.”

— Glenn Dyer

And a recession? Here’s what he said about that possibility:

“When you go back, you can find financial markets signalling recession prior to recessions happening but you also find plenty of occasions where they signalled it and it did not happen. So was it a false signal or a good one? I do not think we can know. My instinct at the moment is I think some of the gloom and doom is overdone. But it remains to be seen.”

— Glenn Dyer

Once again Crikey shows it can regurgitate material even when it still shows scant sign of understanding the material in question.

Only 7 months to go until the world’s highest paid central banker is replaced by the world’s higher paid central banker.

Expect nothing to change with another carbon copy official from the RBA – Phil Lowe – waiting on the conveyor belt for his turn to feed at the RBA trough.

Having facilitated two economy wrecking bubbles – the mining boom and the home valuation boom – one has to ask what exactly has the RBA achieved the past 9 and half years.

How is it possible that a bank teller with a very fancy title is paid nearly double that of the PM.

Just one more example how high end salaries have become completely disconnected from reality. It’s not the 1% – it’s the 10% working for the 10% who are the real sponges.

I’m not so convinced that the exchange rate does matter that much, except for multi-nationals. It doesn’t affect the man on the street particularly, except in whether he goes overseas for holidays.

I would agree with you Simon, except what the Head of the RBA gets paid is a pittance to what they are paying in the private sector. I’m not sure of the truth in what follows, even I find it hard to believe, but at least one paper stated that one of the recent cowboys who got his marching orders from the corporate banking sector had received a $5m bonus in the previous year.

Bonus!

Yeah, it didn’t sound right to me, I hope it wasn’t, but the head of the RBA would be getting paid what an average executive in the banking sector gets.

The bizarre thing is that failure ion the corporate cowboy sector is no reason not to get a bonus.

Something to do with KPIs having SFA to do with reality?

The basis on which bonuses can be earnt, AR, is far less quaint than the Crikey Commissariat pretends.