The foundations on which the proposed large company tax cuts have been built are shaky. The government’s own modelling shows that the growth dividend is so small as to be within the margin of error and a long way into the future — perhaps 30 years.

Worse still, the government’s own research cites UNSW modelling, which showed a potential fall in jobs associated with a company tax cut — perhaps for as long as 10 years. This would be followed by only a slight permanent increase, which would be so small as to be less than is normally gained in a month of normal job growth.

The economic case for a company tax cut is collapsing. That is presumably why Finance Minister Mathias Cormann chose to play the man and not the ball when he attacked The Australia Institute this morning. This is a pity, because while we have argued strongly against the need for large tax cuts in the current climate, we have applauded the government’s moves to begin to rein in the generous tax concessions for superannuation.

The minister and the government argue there will be a growth spurt from cutting the company tax, which they say will cost $48 billion over a decade. And, of course, if you spend $48 billion there will undoubtedly be an economic impact; any spending or tax cut of that size will create some economic activity. The real question that economic models should test is, of all the different ways to spend $48 billion, what delivers the best and biggest economic return? And this is where the company tax cut is found wanting. The supposed benefits are tiny and a long way in the future, while the costs to the tax payer are up front.

We already know that the tax cut will deliver an estimated $7 billion to the banks in the space of just three years. There is little evidence to suggest that it is a wise use of such a large amount of revenue. Even if you wanted to help businesses grow, targeted industry assistance would no doubt have a better rate of return.

And now we find out it is worse. Today’s report from The Australia Institute’s David Richardson shows that a big beneficiary of further cutting Australia’s company tax cut will, in fact, be the US Internal Revenue Service.

The US is by far the largest foreign investor in Australia, accounting for 27% of all foreign investment — despite all of the alarm about Chinese investment, which accounts for 2.3%.

The existence of “bilateral tax treaties” between Australia and other countries (such as the US) mean that a reduction in Australian company tax does not necessarily result in a reduction in company tax paid. Rather, foreign companies can simply find themselves paying the same rate, but in different proportions to different governments.

Here’s how it works. Foreign companies have to pay tax in their place of residence. Under the various foreign tax treaties with Australia, a tax paid on one jurisdiction can be used as an offset against tax payable in the home country. Hence, US companies receive a tax credit for tax paid in Australia, which they can apply against their US tax — meaning they just pay the difference to the IRS. Since the US tax rate is bigger than Australia’s, the IRS is the winner.

As an example:

A US company called “Jobs&Growth Inc” earns $100 million in Australia and pays company tax of 30% — so $30 million. When filing its US tax return it declares income of $100 million, but tells Uncle Sam that it already paid $30 million Down Under and so claims an offset. The present US company tax rate is 35% so Jobs&Growth inc owes $35 million less the $30 million credit, and gives $5 million to the IRS. If the Australian company tax were to fall to 25%, the Australian tax base would be out $5 million, but upon filing in the US, Jobs&Growth Inc would only have a $25 million credit, and therefore owe $10 million to the IRS, up $5 million.

To evaluate: Jobs&Growth Inc is no better off. The ATO is short $5 million. And the US Internal Revenue Service just doubled its money to $10 million by pocketing the $5 million Australia lost.

Using the assumptions outlined here, we estimate that when the full company tax cuts are implemented in 2026-27 the Australian taxpayers will be making a gift of US$732 million per annum to the US government. Over the decade beginning in 2026-27 there would be a gift of US$8.07 billion to the US government.

The economic case that this policy will create jobs and growth is weak, particularly if these cuts are paid for, even in part, by cuts to services and real, actual, right now jobs of teachers, nurses and other public servants.

Cutting company tax to boost growth is trickle-down economic theory at its worst. But even if you take that as gospel, the benefits are by-and-by, through invisible forces like “confidence” and “competitiveness”. The practical, real effects of cutting company tax rates is a huge hit to a revenue stressed Australian budget, and includes a generous gift to the United States.

Recently, 50 prominent Australians including Bernie Fraser, Peter Doherty and Carmen Lawrence called for both sides of politics to abandon any plans to cut taxes, in particular company taxes. Australia has a revenue problem and remains the seventh lowest taxing country in the OECD.

Elections can be dangerous times as politicians are lured by the idea that cutting taxes produces a sugar hit of public and business support. But in the wake of successive tax avoidance scandals and increased understanding of the need for a solid tax base to fund services and infrastructure, the community may be ahead of its politicians.

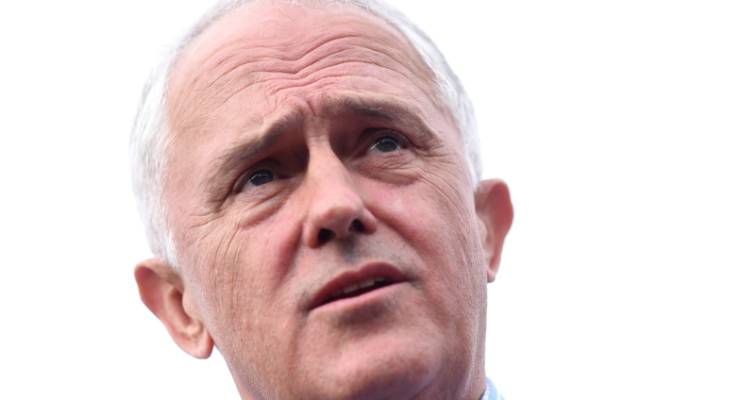

Hmm…not much of an economic plan for growth and jobs. Methinks Malcolm is a snake oil salesman.

He is delivering to those that donate to the Liberal Party – in a ratio of 100:1?

So they can donate more to his party?

Surely in this fairly shallow Duncan Storrar style article you could at least find room to mention the diverted profits tax which is going to have the opposite to this “evil corporation” lurk you are so excited about?

Though I favour company tax, the fact remains that companies tend to pass on their costs to their customers and corporate tax is another cost. Added to this is the global downward shift in company tax that incentivises companies to move to a lower taxing environment. While you are so concerned about the $47bn you think the government would lose, why don’t you think about the risk of Australian based multinationals shifting offshore and taking their international profits with them?

You cling to this left wing notion that profit is sinful, corporations are evil and that the Duncan Storrars of this world are the eternal victims. You even have a pejorative word or two for it. “Supply side economics” and “trickle down”. I even heard Shorten using them. You are actually describing the heart of Australia’s market economy, the economy that has generally grown steadily since such sensible economic reforms were introduced by the Hawke and Keating governments.

That is not what supply-side economics is.

David,

How exactly do companies manage to pass on their company taxes to their customers? If they do manage to do so, in a competive market, it’s effectively just price gouging. And will just cause profits to increase, so that company taxes increase, which (according to your logic) cause the companies to increase their prices again in a vicious cycle.

Hi Ben. I think you should have factored exchange rate differences in your little example about Jods&Growth Inc. When filing with the IRS, they would surely nominate Australian income of US$75 (assuming an exchange rate of 0.75) on which they paid Australian tax of US$22.50. The IRS would then ask for a top up of the difference between this amount and 35% of US$75 = US$26.25. The top up would thus be US$3.75 not US$5. Not sure how this affects the validity of the rest of your report ….

This is a beat up. If companies were anxious to pay US tax they wouldn’t base their headquarters in places like Ireland with low tax rates or divert their profits there.. They are more likely to invest their profits to expand the company than give them to the tax man and this can only be good for Australia. They could still divert profits but it won’t be the US that gets the benefit.