Ever get overtaken in enthusiasm? Once upon a time you’re out on a limb. Then suddenly everyone’s further out than you. That’s where I’m at with Keynesianism.

I have good bona fides as a Keynesian. I’d only just left Treasury when the $900 payments came out that helped save us from the global financial crisis. I’ve always disputed the rewriting of history that says hard spending wasn’t needed. Even in 2012-13 I was calling for more spending as the economy wobbled. I really believe in the power of government spending to lift a moribund economy.

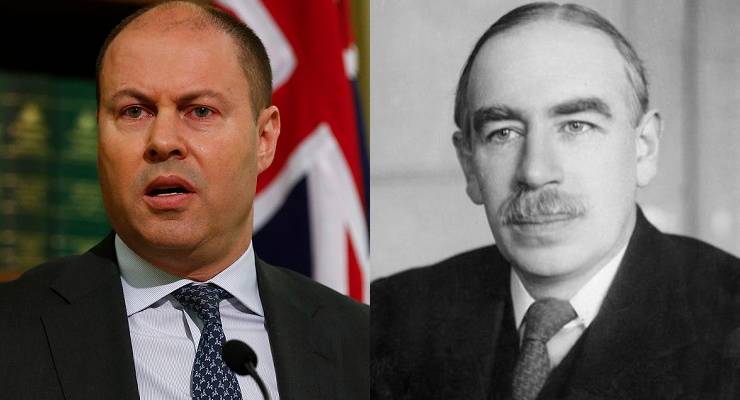

Now everyone agrees. Even Josh Frydenberg. Government outlays in the June quarter were around $60 billion higher than usual — $193 billion where we might have expected around $130 billion. That increase is mostly JobKeeper.

So what is Keynesianism?

The basic idea is that government ought to put more money into the economy when the economy is weak. Build roads, give handouts, etc.

The argument levelled against Keynesianism is that if government spends more, debt builds up. So by trying to avoid the inevitable dips you’re just moving the burden to other people. This approach borrows a principle from physics. Matter cannot be destroyed, just transformed, and the same is true for economic weakness. We either experience it now or by a Keynesian approach delay it.

This argument is the basis for austerity policies and it is buttressed by the idea that economies with a lot of debt grow slowly (e.g. Japan).

The counter-argument to this counter-argument is that when economies dip, they don’t regain their former growth path. People tipped out of work in recessions don’t always find jobs again later on. In fact, unemployment is known to kill work skills, i.e. to erode human capital.

I subscribe to this argument. If you avoid or minimise a recession your economy is stronger such that paying back any debt is relatively easier. If you let the economy shrink, it never catches back up, as illustrated in the following graph (source: Summers, L. 2014).

After a lot of huff and puff about debt and deficit, when push came to shove, our government embraced Keynes with an enormous bear hug. Trying to keep the dip of this recession a small as possible so we lose as few jobs as possible and hew closely to previous estimates of potential GDP.

The effect of Keynesianism is powerful. Just look at yesterday’s GDP numbers.

GDP went down, sure. But household income went up. Profits went up. And saving went up. That’s an impressive trio to achieve when the economy shrinks by 7%. It should not pass without comment that we saw household income rise in a recession. That’s startling. It allows some people to raise the question of whether the government did too much.

Another way to look at the financial soaking administered to the economy is it builds up reserves. Households took the extra income they received and saved it. Commonwealth Bank economist Gareth Aird refers to that as a “war chest”. Later, when official fiscal support begins to taper off, households can raid their war chests to smooth over any remaining deficits in income.

But how and when to taper fiscal support is the big question.

In the perfect world you remove the government support one dollar at a time just as natural economic activity rises, in order that the economy feels not a jolt. In practice that’s impossible.

So when do we taper the fiscal support? Do we err on the side of early removal of stimulus, keeping an eye on the debt? Or do we keep the taps flowing so long as the economy is performing below potential

My head says to keep the taps flowing. But my gut keeps glancing at the debt. Economists have been wrong before. What if excess debt burdens do crimp growth? Certainly once the debt is there it is slow to remove. Intellectual humility is vital. Keynes himself famously said that when the facts change, he changes his mind. It’s a good reminder that what we believe to be true today can be wrong tomorrow.

And yet, one way in which the facts of the matter could change is if we experiment with modern monetary theory and find it to our liking. That theory could take us to another extreme — one where governments can print and spend money so long as inflation is low. And inflation is certainly low. If the Reserve Bank can simply print Australian dollars to cover our national debt, then any perceived limits we feel now will vanish for as long as inflation is below its target.

If history is any guide, building up debt in the service of saving an economy is a thankless task. One thing is sure: we’re going to have an ugly fight when all this is done over how much debt was built up, and what it achieved.

Surely where the money is spent is significant. Recent conservative governments have refused to spend on (and in fact continue to de-fund) higher education specifically, and R&D in general. Expenditure in these areas tends to build human and intellectual infrastructure which translates into greater productivity in the longer term. Money spent in these areas could more rightly be seen more as an investment than a cost.

Instead the government wastes its largesse for tax cuts to corporations which does nothing to stimulate the economy (George W’s failed experiment here should be a compelling case study, not to mention all those who have mimicked him with the same lack of result). No wonder even pre-covid, the economy was bumping along rock bottom growth. Similarly, ‘Jobkeeper’, which is unsustainable, has delivered dividends to the rich while ‘Jobseeker’, which is arguably both sustainable and morally imperative, delivers direct stimulus to the wider economy.

If Keynesianism tells us anything it is that socially directed spending can stimulate the economy long term. The scattergun of ideological spending on the other hand (aka rorting the coffers to prop up your mates’ fossilised businesses) does nothing good.

It will be interesting to see the reason the Coalition concoct when they somehow blame this debt on Labor.

It seems not so long ago that heated accusations were taking place in Parliament about the reckless (?) spending by the Rudd government during the GFC – the spending which saved us from a recession. Morrison & Co are now throwing approximately three (or is it more?) times the amount of money at this crisis.

But eventually when this pandemic passes there will be no insulated homes or school assembly halls as evidence of their largesse. And definitely no social housing.

Who did the Government borrow the debt from?

Who is the Government going to pay the debt back to?

This whole idea of Federal Government debt in Australian dollars is absurd, as the Government does not borrow foreign currency.

And if every country now has massive debt levels due to Covid, who is owed the debt? Is it the 1%? Or maybe Mars?

The problem with the Government’s big spend is that it is simply throwing money at businesses and households. This will increase savings but it will not necessarily increase investment. Investment is what is needed and the government has, so far, failed to do what is necessary. Investment is social housing will ensure that construction businesses employ people and ensure that Australia does not continue with such unaffordable housing. Investment in clean energy will also help. Now that methane can be created at 100 degrees C from CO2 in the atmosphere and Hydrogen from solar powered hydrolysis of water, it is silly to continue with natural gas extraction. We should be building huge solar farms where the sun shines most and transmitting electricity to where we can produce hydrogen and then methane. A large investment scheme like that will lower crippling electricity and natural gas costs, which will help business to invest too. And, while inflations is low, and further lowered by social housing and solar powered hydrogen-methane investment, we can print money to help pay off debt. The government is not yet Keynesian enough nd delay might cost Australia dearly.

Too sensible, too practical, too obvious – you’ll ne’er be in this current shower.

I agree with most of Jason’s piece, but I think he’s worrying too much about the wrong debt. Private debt, especially household debt, is the bigger worry. If, in seeing hard times ahead, debtors attempt to pay down their huge mortgages – which, after all, are based on little other than a property mania, deliberate government encouragement and unconstrained bank credit – they will spend less in the wider economy, occasioning more government debt or money ‘printing’. If house prices collapse and households’ equity levels crash while they are under increasing ‘mortgage stress’, a worse disaster will develop, as easily imagined.