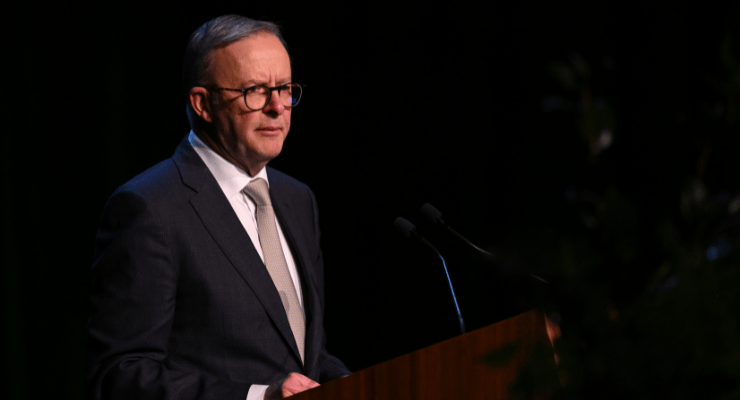

Anthony Albanese has created an unpleasant precedent for himself after speaking with Neil Mitchell in Melbourne yesterday.

Prodded by Mitchell about the impact of interest rate rises and the likelihood of many more rate rises to come, the prime minister noted that “the Reserve Bank sets these rates independently of government”.

Perfectly correct — and he should have left it there. But he went on to suggest that if more extreme finance sector forecasts of four rate rises come to pass, “that would place real pressure on people”.

That’s a statement of the obvious, but borders on suggesting that the RBA would be wrong to do it. Then he went further.

Of course, the Reserve Bank will make its decisions based upon their assessment of where the economy is at. But they need to be careful that they don’t overreach as well.

That too is a rather anodyne statement. Heck, we should all be careful not to overreach, on anything. Who among us has not overreached at one time or another? Overreach is never good. But he has now set up a question for himself from journalists in the future, one to be asked after each rate rise from now on: “Do you think the RBA has overreached?”

It’s his word, one he chose to use, not one suggested by a journalist or interviewer. So it’s reasonable for the media to ask in the future about his view on it. And it’s a fairly subjective issue — an inflation dove’s overreach is a hawk’s underreach. In future press conferences, there could be more reaching than a Lee Child novel.

It could also be viewed as a subtle form of pressure on the RBA. What will the government do if the bank “overreaches” — especially while the bank is being reviewed?

It’s a problem politicians haven’t had to contend with for more than a decade: being asked to reflect on the RBA’s decisions to tighten monetary policy. But Albanese himself was a senior member of the past government that faced rising interest rates, back when the mining investment boom and the recovery from the financial crisis saw seven 0.25% rate rises in just over a year between 2009 and 2010. Statements of the bleeding obvious don’t merely hold the potential to undermine the RBA’s independence, they can create a rod for your back down the track. Best not to overreach on that front.

I’d say Albo is dead right. Lowe is guilty of serious overreach with his brainless comments on long term rates. The RBA has a job to do, and it would be a good thing is that was its primary focus, rather than making unwise statements. The RBA has done more backflips this month than a whole gymnastics competition.

I think that you’re over interpreting the PMs comments. He is perfectly entitled to make these relatively anodyne comments in in the context of a lightweight talk back radio interview. Nothing to see here, boyo.

Why on earth /shouldn’t/ the government of the day have anything to say about a pretty core aspect of economic policy? I mean, we go to the trouble of electing them to run the country, what exactly is it about /this/ particular aspect of running the country that makes it off limits for them?

There are obvious and irrefutable arguments for having non-politicised and independent bodies like courts to administer justice and the legal system, there are obvious and irrefutable arguments for having non-politicised and independent bodies to provide oversight over various other aspects of civil society, and there are obvious and irrefutable arguments for having non-politicised and independent bureaucracies to implement policies and provide advice to government. But what argument is there for having a non-politicised and independent body to actually /make/ policy decisions? That’s literally the point of democracy! We democratically elect the people we want to make those decisions for us, and we build institutions around those democratically elected decision makers in order to implement those decisions properly.

This insistence on unelected independent technocratic bodies as a solution to the failings of democracy are one of the reasons democracy is in crisis – people scream about the failings of democratically elected representatives and the systems built around them, and then rather than trying to fix these failings through more or better managed democracy they insist on moving /away/ from democracy, as if democracy itself can’t be trusted. Is it any wonder that more and more people are losing faith in the whole idea?

I’d say this is just another example not only of BK’s antipathy towards Labor. Basically it’s just a pointless bit of clickbait, with the main objective to try to depict Labor and Albanese in a poor light. Time to write some serious articles, BK, and leave the nonsense to Sky after Dark.

Bill have you read the RBA website on this process, I suggest to do and the truth will be revealed. RBA + Treasurer agree , if not Governor General decides. And I honestly suggest you dont take my word for it either and read the info on the site.

The gov has something to say, the tressurer has to agree with the RBA else the Governor General decides.

Have a read of the RBA website, the truth is in the “orginal sources”

Me Albanese has already been over generous with Lowe who should no longer have a job.

And add Pezzullo to that.

Why stop there -the Grafton Report indicates a massive clean out across the board is needed if executive govt can function properly

We’ll just ignore the obvious mistakes made by the RBA over the last several years.