Large sections of the commentariat may rightly regard the stage three tax cuts, legislated to commence on July 1 2024, as regressive, unhelpful to low- and middle-income earners, and fiscally reckless given the budget deficits locked in by the Coalition when Scott Morrison permanently expanded the size of government in Australia.

But the idea of Labor ditching them is so profoundly toxic that it is impossible for the government to contemplate for a moment. This is a party still traumatised by the way Tony Abbott crucified the Gillard government over its perceived broken promise regarding a carbon tax. That wasn’t even an actual broken promise. This would be a full-blown breach of faith with the electorate, for which voters would be entitled to feel misled and dudded.

Don’t think a Dutton-led opposition — irrelevant, disunited and ineffective for the moment — wouldn’t seize on it with the enthusiasm of Tony Abbott seizing on a lie about the effect of a carbon price. Some of the same liars — like Barnaby Joyce of the $100-leg-of-lamb fame — remain in Parliament. And News Corp remains News Corp, ready to run a propaganda campaign against Labor. The 2025 election would become a referendum on the tax cuts.

Labor won’t even contemplate adjusting the timing or delivery of the cuts. Paul Keating tried that with his L-A-W tax cuts — bringing half forward a year and paying the other half in super — and copped a hiding for it.

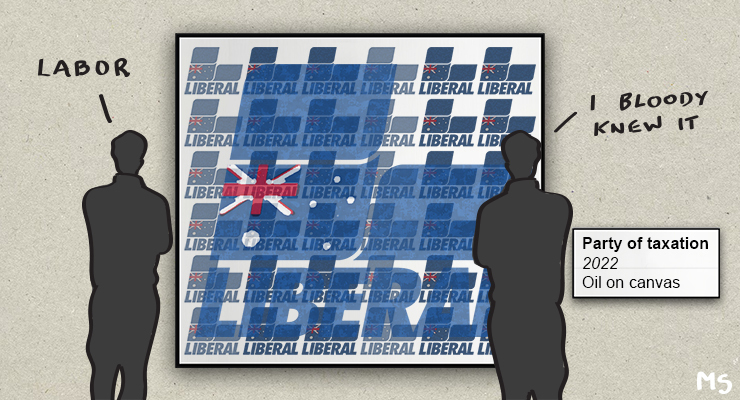

Ditching the tax cuts would also play to the Coalition’s standard line that Labor is the party of higher taxes. As Crikey has repeatedly explained, the Coalition is the party of big tax and has always been. In terms of tax to GDP, Malcolm Fraser and John Howard increased taxes from levels inherited from Whitlam. John Howard and Peter Costello pushed taxes up from the levels inherited from Hawke and Keating. Kevin Rudd and Wayne Swan presided over cuts to tax to GDP. After returning to office, the Coalition increased tax to GDP yet again until the pandemic. Still, press gallery journalists and voters assume the opposite is the case.

And even with the 2024 tax cuts, the Coalition planned to push tax to GDP back up — back to the high levels of the years right before the pandemic, at nearly 23% of GDP. The only sign of the $15 billion impact of the cuts is that the overall tax take is forecast to rise in 2024-25 slightly less briskly than the years either side.

There’s also a basic question once you start breaking promises — why break this one and not another? For the solution of the problem of how to pay for a permanent increase in the size of government, why not a windfall profits tax on fossil fuel companies first? Labor didn’t explicitly rule one out, though it did confine its tax reform promises to the ever-popular multinational tax issue, suggesting everything else was on the table. There’s a far stronger equity and environmental rationale for taxing fossil fuel companies for making a fortune from our resources.

Some observers understand that Labor could never commit to reversing the tax cuts from opposition. But they argue that with the government having the advantage of incumbency, and the capacity to shape debate, it’s time to put these unsustainable tax cuts up for public debate.

But public debate in Australia isn’t some pure contest of ideas held in good faith between reasonable participants. It’s instead infested with vested interests, malicious participants, propaganda and misinformation. This isn’t the mid-’80s when the Hawke government could mull multiple tax reform packages in public.

If only it could put a tax on bad faith, we might get somewhere.

Definitely. Scrapping the stage three tax cuts would restore the Liberals overnight and give them all the ammunition they need for this parliament through to the next election. We would never hear the end of it.

But then Keane poses the reasonable question “There’s also a basic question once you start breaking promises — why break this one and not another?” but he only suggests a windfall profits tax on fossil fuel companies. That’s far too timid. If Labor takes the critical and dangerous step of breaking one of its clearest tax promises it would have nothing to lose by doing everything it can to reform tax while it is still in government. That would include realistic resource taxes on multinationals, an end to negative gearing and the dividend imputation scam, closing off various loopholes including moving profits overseas to avoid Australian taxes, higher rates of income tax on very high incomes, equivalence between income tax and capital gains tax rates, and so on. Then at the next election Labor would be able to show real and substantial achievements to the benefit of the great majority of the Australian public. If that does not work, might as well be hung for a sheep as a lamb, and at least it would be an honourable defeat.

Let’s be honest, the stage 3 tax cuts are absurd.

If Labor doesn’t ditch them, perhaps they could rewrite them so that the benefits are more evenly felt across taxpayers.

I don’t see much chance that would work. The cuts may well be absurd but that does not help Labor one little bit because they were absurd when Labor voted for them. Any attempt to change them would be a reversal of its position which, during the election, it promised to maintain. It would be portrayed as betrayal no matter how it goes about it. Ditching the cuts entirely or changing the terms (it requires legislation either way) would result in the same response and the same damage to Labor’s credibility.

Plenty of governments have reversed themselves on election promises or things they supported in opposition.

The current economic situation should allow the tax cuts to be reframed. changing the target of the tax cuts to the lower end of the scale will help those who suffer most from inflation, but tax cuts in the lower tax brackets also benefit those in the higher brackets.

Yes, but you seem wholly unable to grasp what Keane is talking about. Labor has wedged itself as firmly as it possible in every way to seeing through these tax cuts and the cost of changing its position would be an even bigger gift to the Liberals than Gillard’s problems over her carbon price. The lack of any logic or justification for the tax cuts and the history of other governments changing their minds do not change this at all.

Your screen name is well chosen.

Seriously, you think the people of Australia will go crazy if the 4% making more than $120K don’t get their promised abolition of the 37c bracket? How many people even realize that’s what’s involved? Besides, I’m not convinced Abbott won because of the “carbon tax” (which affected everyone). He won because Labor was in utter and total disarray and incompetent to govern. Remember how awful it looked with Rudd constantly backstabbing Gillard at every opportunity?

More than enough of the wonderful people of Australia went crazy when Gillard introduced the carbon price, or were driven crazy over time by the incessant campaign that followed. The details do not matter, the justice and good sense of it do not matter. You are looking at irrelevant details when you you start talking about ‘what’s involved’ because almost nobody cares. What matters is what Keane says – if Labor messes with the stage three tax cuts it will be crucified. All you will hear all the way to the next election is the accusation that Labor lied. The Liberals and the Murdochs have more than enough material to work with, and the accusation will actually be more justified than it was with Gillard, because her carbon price was not a tax despite what the Liberals said. The Liberals will able to produce any number of video clips where Labor ministers say these tax cuts will be implemented. If not, every time a Labor minister appears the question will be ‘Did you lie about the tax cuts?’. What can the minister say? ‘No’ would be obvious nonsense on a Trumpian scale and make it worse. So the answer must be, ‘Yes, but-‘; and that’s it, game over, the argument is lost and nothing else Labor says will carry any weight.

“ How many people even realize that’s what’s involved? ”

That’s the problem, Daniel. Nowhere near enough. Most of the electorate have no interest in politics at all. They barely look up when it’s time to vote. They’ve heard about the stage 3 tax cuts and assume they’re getting them, too. They have no idea they aren’t, but if Labor don’t deliver “their” tax cut, that will be the end of Labor. The electorate will think something was taken from them and behave accordingly.

We have no laws protecting truth in political advertising, remember and politicians can say whatever they like under parliamentary privilege. How do you get through to the overwhelming majority of the electorate that all they’re going to get from the stage 3 tax cuts is a higher tax bill themselves to pay for it this late in the day amidst years of lies and disinformation?

I agree,it will be neoliberal media that does the damage , not the Coalition, balanced open discussion or debate is impossible in the current climate

Yes, while BK is essentially right about the political response from the Murdoch mongrels and the the Dutton LNP, there really needs to be some courage and honesty shown. This would mean the ALP and Albo actually taking a stand on the principle of fairness AND fiscal responsibility. So much has changed since 2019 and the ALP had no real choice in their acquiesence. However, it is entirely reasonable to change the focus to lower and middle income earners and lower the overall cost to the budget. They would have to mount the argument and stick to it with conviction. Fairness you would like to think would win the day!! Ever hopeful!!

Voter’s have already shown they aren’t stupid when it comes to recognising extreme incompetence and naked corruption. What Bernard and you are not considering is the real, actual exigency of changing course on the impending tax cuts and the loss of both opportunity and credibility which will follow on from the massive and unnecessary loss of revenue, and the many ramifications of that. Those considerations go to the very heart of Labor’s handling, and perceived handling, of the economy and how they intended to make it a fairer one.

Labor has inherited a basket case, and the revelations of Morrison’s Trumpish, secret, banana-republican assumption of various ministries only helps to confirm what must have been solidifying in the hive mind of most of the electorate in the last few months, which is that the LNP’s superior economic management and governance are myths. Labor will lose much more by sticking to the stupid, fatal wedge politics of the tax cuts than it will by abandoning them for the right and urgent reasons; Bernard’s recommended course is going merely to demonstrate the triumph of wedge politics over harsh reality.

Not a fan of the stage 3 tax cuts from a fairness perspective, but you’d think there’s more than enough legal loopholes and “legal” tax evasion going on that tens of billions could be restored to the bottom line by other means. Don’t remember any election promise that said multinationals should keep avoid paying tax through complex overseas ownership arrangements.

The biggest hole in the tax revenue base is the cash economy. But no one seems to want to fix that.

Along with money laundering, overseas marketing hubs, and billionaires taxation loopholes created by multinational accountancy firms.

Yeah, tradies & gardeners are keeping this country starved of tax revenue – nothing at all to do with transfer pricing, internal loans between O/S head office or overpriced products ‘sold’ to the branch office here.

It’s a wonder the Caymans haven’t already sunk beneath the waves with all the ill gotten & flthy lucre stashed there.

That was supposed to be the reason for the GST – intended to obviate ALL other state -payroll, land, stamp duty etc – and many federal imposts,aka taxes in order to make Australia safe(r) for multinationals to gouge and exploit without having to other paying a fair share of the revenue derived.

Didn’t happen, won’t happen.

Even (HA!) with a ‘Labor’ (hysterical HA!!) government – thanks to PJK et al

Wasn’t the GST supposed to fix that?

Didn’t the pandemic help the move away from using cash and towards all transactions being official?

That said, I got stiffed by a locksmith the other day who was more than happy to hang around until I went to an ATM for the king’s ransom he charged.

I don’t like the Stage 3, but I am glad that Bernard has brought everyone back to brutal political reality.

Labor allowed itself to be wedged re these miserable tax cuts, and now faces the consequences. I wonder if these guys will ever regain confidence in themselves and their voters. There’s no better time than now considering the state of News and the opposition.

Labor did no such thing. The Bill before parliament contained three stages of tax cuts…stages 1 & 2 benefited lower and middle income taxpayers…these are already in place.. while stage 3 grossly cut the taxes of high in-come earners…due to be introduced in July 2024.

The major problem with this arrangement was that this was an ‘Omnibus’ bill…if Labor didn’t pass the bill in total, NO ONE would have received any tax cuts. They opted to vote for this bill so stages 1 & 2 could proceed, and benefit those most in need of tax cuts.

Because of the underhand behaviour by the L/NP when in power, I believe that Labor should explain this, in gross detail, to the public and then take their chances. There is no way inequality needs to be made worse by allowing these stage 3 tax cuts to proceed. I’m sure the Greens and others in the Senate would vote to repeal this so-called legislated monstrosity!