Australia’s billionaire wealth swelled 61% over the course of the pandemic according to a new report, prompting renewed calls for a rethink on the government’s stage three tax cuts ahead of the May federal budget.

The analysis was published on Monday as part of Oxfam’s annual inequality report, which found there are 11 more billionaires in Australia today than there were in 2020, while Australia’s richest 1% in total pocketed more than $2500 per second, or $150,000 per minute, over the past decade.

Oxfam Australia program director Anthea Spinks told Crikey the findings should open the door to renewed debate over the introduction of the stage three tax cuts, set to take effect from July 2024, along with broader tax reform targeted at cauterising income inequality in Australia.

Researchers at Oxfam join a growing group of experts — and at least half of the 18 crossbenchers in federal Parliament — who have come out in opposition to the tax cuts since Labor took office in May last year.

The cuts, which are the final phase of the former Morrison government’s tax plan, will do away with the 37% tax bracket altogether, lower the 32.5% bracket to a flat 30%, and raise the threshold for the top tax bracket from $180,001 to $200,001.

In effect, the cuts will see those with an annual income of $200,000 end up paying the same rate of tax as someone earning little more than the minimum wage.

In December, more than 100 leading economists and tax experts signed an open letter, printed as a full-page advert in The Age and The Sydney Morning Herald, calling on Prime Minister Anthony Albanese to reconsider his position on the tax cuts.

Some of the letter’s high-profile signatories included Nobel Prize-winning economist professor Joseph Stiglitz, former Reserve Bank of Australia governor Bernie Fraser, former ACCC chair professor Allan Fels AO, and tax expert professor Miranda Stewart.

“Stage three of the previous government’s personal income tax changes was always unfair and unaffordable. It is even more so today and prospectively, on both counts,” Fraser said in December.

“The choice ahead for Labor could not be more clear-cut: it can stick with its [politically] ‘phoney’ commitment to stage three, or it can choose not to go down this path and channel the substantial savings involved to the many very valuable — but very expensive — social reforms promised in the lead-up to the last election.”

So far the government has shown no sign of walking back its support for the package, or of opening the floor to debate on a potential redesign of the suite of reforms.

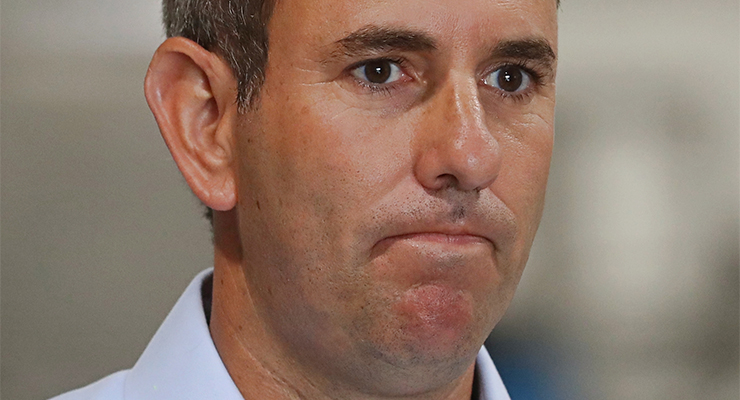

Earlier this month, Treasurer Jim Chalmers doubled down on the government’s commitment to the cuts, just months after updated government forecasts reported a cost blowout of $11 billion, costing the budget $243 billion.

At a press conference, the treasurer said Labor was working with state and territory leaders to deliver further cost-of-living relief in May’s budget, but that a redesign of the cuts wouldn’t be part of the solution.

Australia Institute executive director Richard Denniss told Crikey that Oxfam’s analysis is the “clearest proof” available that inequality continues to rise in Australia, and that delivering reforms conceived under very different circumstances remains “absurd”.

“That said, Labor went to the election promising to deliver those tax cuts. But even since those promises were made, the world has changed radically,” Denniss said.

“The Reserve Bank governor was adamant that he wouldn’t increase interest rates until real wages started to fall, and since that promise was made, real wages have fallen faster than ever.

“It would be good politics and good economic policy for Labor to implement a tax agenda that suits our circumstances, not [one that] suits the circumstances imagined before the election.”

The economic and moral cases for scrapping the stage three cuts are overwhelming. The political case is far more difficult because of Labor’s reckless and foolish commitment to support the cuts no matter what, which it has renewed at every opportunity. Changing course, now or later, would be the biggest gift imaginable to the opposition and hostile Australian media.

Anyway, income tax is far from the only problem to address if the government is going to do something about the increase of inequality. Seriously wealthy individuals don’t need much personal taxable income at all. They can do perfectly well with capital gains, which for no good reason are taxed at a low rate compared to income. Automatically keeping income and capital gains tax aligned would help enormously. And will we ever have the guts to do something about the ridiculous absence of death duties? The best way to address that would be to tax bequests above a set limit as income; that would not be a death duty per se because it would only be paid by the living as part of their annual income tax.

What Opposition? If the government simply ignored them, their true irrelevance would become clearer.

And what media? One big conglomerate, to which the government should simply give one big finger.

Even Dutton could not miss if presented with this opportunity. He would only have to copy the tactics used by Abbott after Gillard’s government introduced its carbon price. That was only the appearance of a broken commitment, but it let Abbott do terrible damage to Gillard and her government. Scrapping the stage three cuts would be worse, a real broken commitment, a commitment deliberately made, repeated and renewed over and again in the clearest possible terms. Labor has done all it possibly could to maximise the damage it will suffer if it changes course, and even Dutton could not fail to ensure that damage happens. It’s inevitable. It is irrelevant that changing the policy is the right thing to do. The carbon price was good policy too. What will count is the relentless and unanswerable charge of having lied, having broken a clear policy commitment and being completely untrustworthy. We will never hear the end of it. Labor has made sure of it.

While the carbon price was truly good policy, the issue was sufficiently complex to allow misrepresentation and to make people nervous. This is probably not the case with the tax cuts. There was never any good argument in their favour, and they look sillier by the month. I think Labor should kill the cuts, without apology. I believe Chalmers has garnered the credibility to promote the reversal as a positive.

Do they really want to, is the question, to which the answer seems to be No.

The tax cuts just as easily misrepresented. The only fact that matters is they are tax cuts. So Labor promised these tax cuts, and if it breaks that promise, Labor has reneged on tax cuts. That’s the whole story. Shock! Horror! Can’t be trusted, economic vandals, all tax & spend… The details don’t matter at all, just the same as they did not matter with the carbon price. Every attempt at a rational discussion will be drowned out by all the wailing and roaring about broken promises and increased taxes. (So Labor says the taxes have not increased, they have only not been cut? Do you really think that will make any impression beyond just sounding weak, dishonest and weaselly?) Labor’s enemies just have to keep repeating the line about broken promises and it’s all the public will see, hear and remember. Labor has dug itself into this hole, it is still digging with enthusiasm and so getting out of it gets more, not less, difficult and costly all the time.

TBH, I think that it was 100% deliberate on Albanese’s part. He wanted these cuts to go through, and did everything he could to tie the ALP to them.

Billionaires, I’m not sure what they add much to society other than grief. I’m all for peoples worth being recognised. All for someone being able to amass a good life’s earnings. But, what did Covid show us? Not that billionaires were there daily digging us out or getting us through, but that ordinary, hard-working, low-paid people were. Daily. No break. No sanctuary on islands, or behind walls, or jetting off despite restrictions on the masses. Just hard-workers doing their best.

I could not agree more. And if it is true that the top 1% amassed money at $2500 per second, why not knock it down by $100 per second or so? They’d barely even notice.

Anyone like me who just barely benefits from it, or even those that get a moderate benefit, is not rich enough to feel no impact when government services start to wind back and we have to pay more for everything.

It takes a politician with real courage to admit a mistake and take action to reverse a bad decision. Sadly, we have seen no such courage from Albo et al. To say he is better than Morrsion is to damn him with faint praise. If he wants to be more than a one-term PM, he need to show real leadership on this and other issues.

On this I’m in agreement. The Stage Three tax cuts are a hole that Labor has unwittingly dug to bury itself, but which most people could see coming as a wedge issue. What were they thinking? If these ridiculous and dangerous cuts are to take place as an act of face saving and an avoidance of News Corpse apoplexy, then something akin to what the Ship’s Rat suggests at the top of the page must be actioned in order to claw the money back and redistribute it more fairly.

Come on Chalmers. Things change. Wear the opprobrium. Cancel the Stage 3 tax cuts now. Bugger the greedy. They are the leeches. To hell with Westacott, Hugh Morgan, Innes Wilcox and the drivellers from the AFR. Cancel Stage 3 now!!!

Need to cut the tax dodges that the wealthy can use as well.

They could also reframe the stage 3 tax cuts with more cuts for low and middle income earners (people in the upper tax brackets also get the benefit of them). Then tie the tax rates to the wage index.

Yes! Albo and Chalmers have to be honest….. with themselves first. the Stage 3 Tax Cuts are just plain bad and way out of date- its 2023 not 2018!! The thinking of Sinking Ship Rat is also out of date- the nasty media does not have the same clout as it did in 2013. Demographic changes also are to Labor/Green/ Progressive advantage. The ALP need to be brave and introduce a Better and Fairer Tax regime for the next 4 years Not 10 years!!! Why get locked into the Liberals stupid ideological timetable?? First thing is to raise the Tax Free Threshold (everyone gets a small tax cut!!) ensure the majority of middle income earners get a modest tax cut but the high earners have already benefited over the last decade; and tax the super rich!! It’s so bleeding obvious!!! This is Labor’s and Albos’ moment; history is on their side and they are a very capable group who have the skills to prosecute and win the argument!! Especially when it’s for the next generation/generations!! If Albo does nothing major it will be pathetic and the ALP will suffer the consequences!!!

No, this is fine. People need to wake up to the fact that Labor is no friend of the poor, or even the middle class. In fact, they’re not even friends with the biosphere and the future. And if this sort of bloody-minded giveaway to the filthy 1% is what it takes for people to realise that Labor has stepped into almost the same spot the Liberal party used to occupy, then so be it.

Next parliament will see Labor asking the Greens’ permission for everything. As it bloody well should be.