Momentum is building for a revamp of Labor’s housing policies at its national conference in August, with an unnamed senior MP telling The Sydney Morning Herald: “We need to do something radical on housing if this government gets a second term.”

Last week, conference delegate Julijana Todorovic, convenor of the Labor for Housing group, offered a suggestion: limit negative gearing to just one property per person. Some backbenchers are open to it, despite Prime Minister Anthony Albanese’s reluctance.

Conversely, economist Chris Richardson argued that NIMBYs are the main driver of high prices, so governments should forget tax reform and focus on building more homes. Who’s right?

Porque no los dos?

As Ben Eltham recently explained in Crikey, the housing crisis is a multifaceted clusterfuck — lagging private builds, public housing abandonment, and tax concessions are all to blame, plus more. But different housing experts weight each factor’s relative impact differently.

Various think tanks and academics have estimated the impact of Bill Shorten’s tax proposals in 2019 on house prices would’ve been modest — about a 1% to 5% reduction overall, compared with where they would otherwise have been. Deloitte suggests this could’ve reached 8% for Sydney and Melbourne.

Such reductions are nothing to sniff at. But Todorovic’s proposal is smaller than Shorten’s in scope and therefore smaller in potential impact.

The best reason to scrap negative gearing and the capital gains tax (CGT) discount remains the counterproductive siphoning of billions in public funds to landlords and investors. Plus if that extra revenue was put towards public housing, the effect on affordability could be sizeable.

Recent estimates of the impact of boosting supply are more significant. The Reserve Bank suggests that “every 1% increase in the number of dwellings … lowers the cost of housing by 2.5%”. So if Australia followed Auckland’s lead and increased supply by 5%, we could see a 12.5% reduction in relative prices.

However, significantly increasing supply could take a while even absent entrenched resistance, especially since the cost of building materials has risen significantly.

Ultimately, pitting supply and demand-focused reforms against each other is counterproductive. We can and should do both.

Every homeowner is an investor. Tax them accordingly

While negative gearing and the capital gains tax (CGT) discount hog the spotlight, they aren’t the only tax concession for housing that warrants scrutiny. Another reform would have a bigger impact: limiting the CGT exemption on the family home.

Labor, not yet brave enough to disappoint the smaller and more affluent class of non-occupier investors, wouldn’t touch the deified status of the family home with a 10-foot pole. And given the plausible backlash, that’s probably the pragmatic course for now. But if Australia wanted to do “something radical” on housing taxes, this would be it.

The May budget showed forgone revenue from the main residence exemption and its discount component totalled $48 billion in 2022-23 — that’s more than we spent on Medicare, aged care or hospitals, and almost double the cost of rental deductions. Imagine the public housing we could build with that kind of money.

The beneficiaries would still need to be housed, so removing it wouldn’t free up homes for first-time buyers. But it would discourage excessive bidding on existing stock.

Untaxed capital gains encourage buyers to see houses not just as resources for living and raising families, but as investment vehicles and inheritances for their kids, which encourages speculative competition. It also fosters a culture where housing is the mainstream investment choice; where young people, singles and retirees are encouraged to get into or stay in the market, often putting them in financial stress, even if renting would better suit their lifestyle.

And far from being a subordinate concern to NIMBYism, this concession fosters it. If you’ve tipped all your savings into one tax-free cash cow, you’re going to guard its value jealously. That value hinges on scarcity. No wonder so many homeowners weaponise the planning system to fend off nearby developments.

Towards a mansion tax

Earlier this year, the not-exactly-bleeding-heart International Monetary Fund recommended targeting the main residence exemption for reform, telling the AFR it was “more generous than what you see in many other advanced economies”.

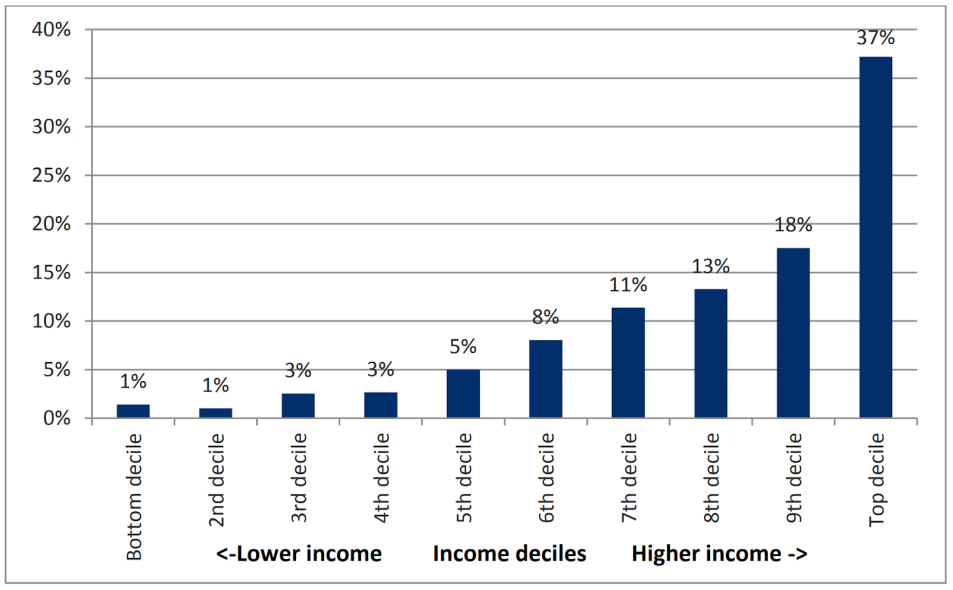

We could start by capping it. In 2016, the Australia Institute found the benefits of the exemption are highly concentrated among the richest landowners. And they will become more concentrated as the home ownership rate falls.

Thus researcher Matt Grudnoff suggested limiting the exemption to properties worth less than $2 million, which would claw most new revenue from the top decile of income earners. And if the ceiling was unindexed (like Labor’s $3 million super concession cap wisely was), its coverage would grow over time.

Other areas for reform could include the treatment of inherited homes and homes the owner lived in previously — you can rent your former home for six years and still get the main residence tax break for the entire period.

While investors hoarding a handful of properties when thousands go unhoused might be particularly odious, middle Australia can’t wash its hands — most homeowners are complicit beneficiaries in the ratcheting exclusion of our housing system.

Yet I fear, at least for now, taking the homeowning family off its pedestal might conflict too deeply with our convenient narratives of suburban aspiration. It might simply hit too close to home.

What a load of sh*te.

Taxing the family home, means people can’t move house (new job, new school, children, marriage, separation, just because) without taking a material step backwards in terms of quality, and that is how everyone should think about it.

It’s a terrible idea and would do nothing to address the fundamental problem of too many people and not enough houses.

Exactly right.

My own first reaction was similar: “Well, that was a bit of a thought bubble, wasn’t it?” Taxing the first home on sale makes selling and buying elsewhere (e.g. downsizing) rather unattractive. Bit of an own goal, there.

not really, if the market isn’t distorted by a pile-on of too many tax breaks.

You sell to move for, say, a new job. You make a capital gain. You lose some of it in tax, meaning, sure, you may not have cash down for an equivalent home wherever your new job is. Except that you may be moving to a cheaper area/lifestyle. You may be downsizing at the same time as changing careers (coz the kids are off your hands). Or you may. e moving to a more expensive area because…the job opportunity is a bid promotion /income rise.

In all of these scenarios, you’re making a decision to move based on many factors, presumably positives. So…where in the Contract Of Life does it say that, once you’ve bought a home, you are entitled – unlike any other asset – to have its value safeguarded by government policy?!? It’s a measure of our national internalised property entitlement that everyone is going insane trying to figure out a way to simultaneously a) maintain the value of homes for those who own one, and b) make homes cheaper to buy for those who don’t.

No, it applies equally in a sensible property market. Capital gain even at ~3% over 10-20 years is still non-trivial. And that is before considering the point of fairness.

You are arse about face.

It is both existing (stamp duty) and proposed (CGT on the family home) Government policy that incurs unavoidable moving costs.

Nobody is suggesting the Government “safeguard” home value (that is a different discussion entirely), but simply that it does not force you to take a downgrade through significant tax burden just because you need (or even want) to move house.

Your position is false. The family home is not the only asset that is safeguarded by government police. There are plenty of assets that are not subject to taxes at sale such as a car and many more. Your underlying position is that the property owner has unfairly gained advantage due to their asset their home changing value because due to the length of time they have owned it. Even though the dollar value has also changed and therefore the government is entitled to tax the said home. The difference is an investment property like a business brings in an income, has expenses and when sold it the asset is worth more then the purchase price you pay tax CGT. The family home does not generate an income only outgoings, therefore by taxing it, it is a negative loss for primary homeowners who sell. Also property investors generally don’t make millions and don’t pay tax, you have made many assumptions about the property sector and homeownership I don’t believe you fully understand.

No.

My underlying position is that if someone moves house, they shouldn’t have to take a step back in terms of quality and utility, just because they moved house.

No it’s not.

The difference is an investment property like a business brings in an income, has expenses and when sold it the asset is worth more then the purchase price you pay tax CGT. The family home does not generate an income only outgoings, therefore by taxing it, it is a negative loss for primary homeowners who sell. Also property investors generally don’t make millions and don’t pay tax, you have made many assumptions about the property sector and homeownership I don’t believe you fully understand.

I’m pretty sure I understand what I’m talking about, but I don’t understand what point you are trying to make. Family homes are not businesses, or investments, and should not be taxed like they are.

Or did you mean to reply to Jack ?

“pile-on of too many tax breaks”

A distorted pile at that, that fails to incentivise the thing it should incentivise (building more houses), at the same time as depleting tax revenue that could be used to build infrastructure, and…gasp…public housing.

Negative gearing on existing properties is an embarrassment. Negative gearing against earned income too. Taxes exist to raise revenue, or to drive wanted behaviour, and the current tax laws do neither

The costs of rehousing (stamp duty / agents fees) are already enough to make people think about moving.

Yes, SD is another odious tax.

Real estate agents are at least providing some sort of service for their fees, even if they are often ridiculous.

Time to stop pussy-footing about the real issue – repeal the proposed Tier 3 Tax Cuts. And then come up with an imaginative infrastructure fund that supports middle income and lower home buyers.

Good first suggestion – those tax cuts are an abomination in the face of the current homeless crisis. But the notion of trying to get everyone to buy their own home fails to take into account that most folk need to rent at least part of their lives. For many, there’s no choice for their entire lives. What is needed is new public houses, a heresy to many neo-libs, and something towards which Labor and the Liberals will have to be dragged screaming.

Or… govts and media should stop regarding affordable and social housing as ‘money down the drain’! Affordable housing elsewhere in the world is regarded as a low return but solid return on investment. Local councils could easily borrow money to build all housing necessary and set rental rates a level (according to income) where moneys are returned over time. This precisely how it works OS. Remember the harbour bridge took 80 years to pay off, but payed off it was. Somehow there’s over a trillion dollars available for military equipment. Dead money never to be paid back. But when it comes to housing, it’s all too difficult. Come on Labor, Do Something!

Agree, part of the psychology of past generation platforming and catering to ‘home owners’ as savvy investors, while cutting back on below median price builds esp. public housing via restricted council zoning (reliant on rate income), and state governments not commissioning anywhere near sufficient stock (when either way it would benefit construction sector); created a ‘moat’.

Agree, part of the psychology of past generation platforming and catering to ‘home owners’ as savvy investors,

LOL. The bloke who thinks property should appreciate at twice the targeted rate of inflation (never mind actual wage growth) thinks people who buy into it shouldn’t be considered “savvy investors”.

The problem is not councils. There are literally decades of supply in already approved green- and brownfield developments. The problem is land banking developers deliberately limiting supply to hold prices up (and loose lending laws giving people the money to pay them).

If you tax the Cap gains on the family home you also need to allow the deduction of interest, and cash used to improve it, for the investment. Homes are also money pits, you don’t actually make a profit because the value of the home you buy has likely gone up by a similar %.

Neg gearing – it should be allowed but you shouldn’t be allowed to deduct the expenses from your salary income, it should only be allowed to deduct against the asset class. The CGT discount should obviously go.

We should scrap income taxes – give the trickle down set what they want, there’s no disincentive to work harder if you’re not taxed. Tax land and wealth

Good ideas, too. (Also, will need a bloody revolution.) We’re about the only nation which allows property costs to offset unrelated income. Our woes started from the post-colonial off, with the rum corps demanding and being given free land, having it upgraded at taxpayer expense, and then avoiding any tax on it when passing onto the next generation. We see untaxed property wealth accumulation as a marker of virtuous, industrious thrift and an aspirational national birthright.

Actually, It’s not entirely but it’s certainly much closer to…unproductive, parasitical freeloading.

If you tax the capital gain on a primary residence then you have to let the homeowner deduct interest costs, and other costs, plus you have the whole issue of depreciation on the building. And then if capped at 2m you still have to keep tracks of costs for when the home value goes about 2m.

Just keep it simple get rid of the 50% capital gains tax after 12 months and return to the old system of an ATO annual amount being set for that year of ownership. Neg Gearing has nothing to do with any particular asset class and was never a real issue until 1999 when the CGT discount was snuck in when no one was looking during the GST lovefest among “those that know.”

Without the CGT discount the whole housing investment scam doesn’t work. Especially if you are negative gearing along the way. At best it becomes a forced savings process which for many people is the key attraction of housing as an investment even when you are living in it and forking out 1000s every month on the mortgage. Now just imagine if the interest costs were made tax deductible on the family home.

Praise the gods sing hallelujah hallelujah hallelujah someone gets it.

That single lousy Howard/Costello CGT ‘administrative tweak’ – designed with epic cunning to seduce middle class Australians into thinking that as long as they stuck with suburban accountant johnny they’d be as canny and as rich as warren buffet – will come to be regarded as the single most ruinous bipartisan fiscal policy catastrophe in our federated history. It’s almost certainly destroyed our post-war domestic productive economy forever, ensuring we p**sed our nation’s greatest resources boom/potential future-proofing strategic investment opportunity up against our brick veneer walls.

Just ditch the CGT discount. There’ll be tears, and pain, but mostly where it’s thoroughly deserved, and the market will at last have a fighting chance to recalibrate its supply/demand metrics sanely. Everything else is just desperately treating the multiple symptoms and comorbidities of obesity without taxing added sugar completely out of the food chain.