Look alive, Australians, for we are the “richest people in the world”.

Or so many media outlets reported last week, after investment bank Credit Suisse released its latest Global Wealth Report.

It found the median Australian’s wealth was approximately $408,717 in 2021, with Belgium, New Zealand, Hong Kong and Denmark rounding out the top five. Almost 2.2 million Australians are now millionaires, up 390,000 since 2020.

According to The Australian’s wealth editor James Kirby, “it’s reassuring to know that we are not just a wealthy society but those riches do get spread around — relatively — better than just about anywhere else”.

Record wealth, evenly distributed — a cause for celebration, right? I hate to burst our bubble, but Australia’s economy isn’t nearly as enviable as these rosy headlines claim.

Growing the pie, but scrimping your slice

Firstly, Australia’s riches aren’t as equally distributed as they may appear. While median wealth (which approximates middle-class holdings) captures economic fairness better than average wealth (which can be inflated by the mega-rich in highly unequal countries), neither is perfect. And on more inequality-focused measures, Australia doesn’t perform so well.

We don’t even crack the top 50 on the World Bank’s Gini coefficient ranking, which measures economic stratification (however, data availability is limited for some countries). And on the OECD’s Better Life Index, we come 24th out of 35 nations in social inequality.

A recent report by the University of New South Wales and the Australian Council of Social Service’s Poverty and Inequality Partnership (PIP) found the richest 10% of Australian households hold an average of $6.1 million, constituting almost half of the nation’s wealth. Conversely, the lowest 60% (with an average of $376,000) hold just 17% of all wealth. These figures aren’t terrible by international standards — we’re no Russia — but many countries are less concentrated.

Credit Suisse notes that while Australia has grown more unequal since 2008, New Zealand has grown less unequal in the same period. Why the difference? It has a lot to do with how each nation’s wealth is comprised — and it makes neither look particularly egalitarian.

What is our wealth made of?

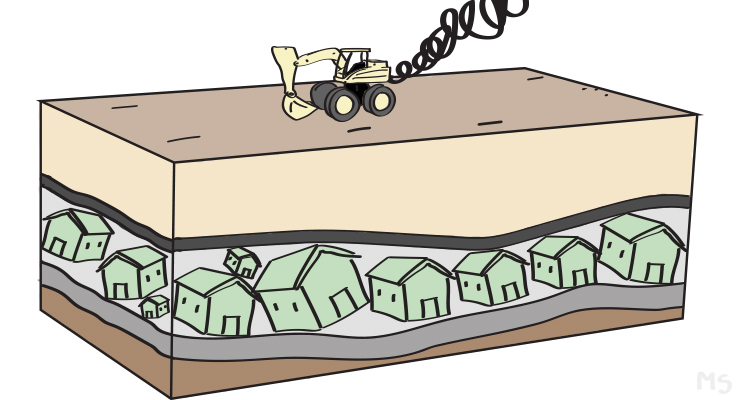

The wealth of both Australia and New Zealand is largely driven by speculatory asset inflation. The PIP found two-thirds of Australia’s increase in wealth during the pandemic came from residential property alone, while New Zealand’s housing market has also skyrocketed.

We both rely on housing much more than our global peers. Financial assets, such as company stocks, comprise about 39.5% of Australia’s total assets, whereas “the typical level for a high-income country [is] 55%”, with the rest made up mostly of housing, according to the AFR. However, Australia’s reliance on housing has eased slightly since 2008 because our stock portfolios (including superannuation accounts) fattened. Shares in mining and resource companies accounted for much of this growth.

New Zealand’s housing addiction is even more globally aberrant because its stock holdings are lower. Since fewer people hold lucrative stock portfolios than appreciating houses, New Zealand’s wealth has been somewhat more broadly distributed.

So while technically New Zealand might have grown less unequal, it’s only because its asset boom has benefitted the larger (but still increasingly exclusive) propertied class, whereas Australia also allowed mining barons to siphon the spoils of our resource booms while paying little tax.

Neither the housing nor resources sectors create significant jobs relative to profits, so their continued growth is more likely to crowd out rather than stimulate broader economic activity.

Meanwhile, The Australian’s Rich List, updated last week, showed investors in innovative, job-creating industries such as technology are sliding, while extractors and rentiers reign supreme. Our increasing affluence looks both exclusive and unimaginative.

You can’t eat houses

Housing also provides fewer realisable medium-term benefits to owners than other forms of wealth. While you can theoretically take out a reverse mortgage to capitalise on your home’s appreciation, few Australians do.

So residents in other wealthy but less housing-reliant countries feel — and for day-to-day purposes are — richer than most Australians.

This doesn’t stop most homeowners from voting to protect their home’s value, for they know it will help them secure their next home (or their inheritors’). We’ve locked ourselves into a spiralling Ponzi scheme for basic goods, subordinating the collective good.

Meanwhile, Aussies’ cashflow for everyday living is less enviable. Australia’s average wages are higher than the OECD average, but a higher-than-average percentage of our workforce takes home low wages, and we’re easily beaten by many European countries with more pro-worker bargaining systems. Our discretionary income is also close to the OECD average — not bad, but hardly world-beating.

Dragging on our incomes are high levels of debt (mostly mortgages). The PIP found Australian households are “more indebted than many other wealthy nations”, with nearly a third of our low-income households “over-indebted”.

Being the “wealthiest nation on earth” is only a contest worth winning if said wealth is actually useful and enjoyable for the vast majority. “Wealth” in the forms of unaffordable houses and Gina Rinehart’s super account aren’t the sorts we should want.

We’d be far richer, in the truest sense, if we were less wealthy but could afford to live well.

How do you feel about the way wealth is distributed in Australia? Let us know your thoughts by writing to letters@crikey.com.au. Please include your full name to be considered for publication. We reserve the right to edit for length and clarity.

If that’s their reason, are they thinking straight? Of course any home-owner (that is, someone who resides in the property) who is thinking of moving is going to be concerned about the sale price of the current home. But if the home-owner wants to move to an equivalent home, it makes no difference if house prices have risen or fallen, because the price of the new home changes by the same. On the other hand, if the home-owner aspires to a more expensive home then what matters most is the difference between the price of the current home being sold and the one being bought. When house prices rise that difference gets greater, making the new home less affordable. Any such home-owner is better off when prices fall, despite getting less from the sale of the current home. And on top of all that are all the costs imposed on those buying property that are calculated as a fraction of the purchase price, such as agent’s fees and stamp duty. Again, the home-owner is better off if prices fall.

The only circumstance where a home-owner should welcome rising house prices is when the home-owner is down-sizing. Also, anyone with a mortgage to pay off is understandably wary of negative equity, but that is another issue. Those who buy houses for investment and profit are of course a different case, they will always want prices to rise.

It’s also difficult to release any value from home equity if you’re out of work. The remaining option of selling up means you either have to move to somewhere with fewer employment options or stay put and pay rent higher than a mortgage.

“Our increasing affluence looks both exclusive and unimaginative.”

Illusory?

“Australia’s economy isn’t nearly as enviable as these rosy headlines claim”

Would seem to be closer to a third world economy than a first world economy. That is, an over-reliance on primary industry.

Although it may be some time before have a parliament to effect tax reforms that is becoming more crucial every year an annual death tax at modest levels is essential to reverse increasing wealth and social inequity.

BA, maybe an annual wealth tax and a once-in-a-lifetime death tax!

Although it would indeed be desirable for the super-wealthy to die annually!!!

Inheritance / Death Taxes are hated by almost everyone. The smug rich silver haired retiree passing on fabulous wealth to their feckless children is a strawman.

Many people only acquire any sort of wealth accidentally – like sitting in their house living modest lives as developers and BTL landlords coin it elsewhere.

Being homeless (renting) in retirement is truely frightening – as is signing up to an absurd loan for a not so good property and watching interest rates rise. The death of parents is often the only way a mortgage gets paid off – this often only occurs as children enter their sixties.

In another universe where it’s easy to get a job and work into your 70s life would be different. In our world it’s easy to be financially derailed – a bad / scam financial adviser, divorce, a spend thrift partner, mental illness, cancer, redundancy, a market crash like we have watched over the last 7 months…

It’s actually terrifying to find how exposed you really are to financial stress after basically minding your own business and being a good citizen for 65+ years.

“Australia is the wealthiest nation on Earth”. Yeah, sure!! Tell that to the multitudes who sleep rough in shop doorways every night in our capital cities and elsewhere, or to the mentally ill who fall through the cracks, or to those who fall into drug and alcohol addiction because, …. well, they are surrounded by so much ‘wealth’.

Whilst I acknowledge that we are better off than many, perhaps most, other nations, we could still be doing much better in the way we distribute this wealth.

Indeed, Robert, you might say that’s exactly why we should be.

Being the wealthiest nation on earth doesn’t mean there is no one struggling.

We should be extremely grateful for the lives we live, for we are (the vast majority) blessed.

Obviously a greater distribution of that wealth would be a good thing, but approx 70% of Australian adults are in the wealthiest 10% of people on the planet. That’s an astonishing stat.

There are more people struggling here in Australia than should be the case, John. We could be doing much better. For instance, we should be seeking to diminish alcohol consumption, the illegal drug trade, and problem gambling. The medical and education systems need to be overhauled, and care for the aged is far from perfect. We have a free-market, ‘dog-eat-dog’, ‘survival of the fittest’ economic system. So John, the ‘laurels’ that you seem to think we have to rest on are rather flimsy at best.

You assume too much Robert.

There are tonnes of things that are unfair in our society, tonnes of things that can be improved. I don’t disagree with any of the issues you have listed. We absolutely could do much, much better.

My sentiment is simply that we are very lucky. We are rich by virtue of being born in, or emigrated to, this country. Billions worldwide look at us enviously, for they were born into true poverty, that for most is inescapable.

Go visit a 3rd world country and see how they live. Wealth is not just how many dollars we have…it’s having fresh, nutritious food easily accessible. It’s having a natural environment that isn’t completely degraded (though we’re trying our best to lose those!). It’s having clean water on tap, and sanitation.

I’ll never forget a village I visited in the Philippines. So, so poor, with nothing, sleeping 16+ in a room we would consider small. It moved my 6y.o. daughter to send money to them when we returned home. My brother did some charity work in Thailand, working with Burmese refugees, many of whom had to scavenge a living from the Mae Sot refuse tip. They lived there, cooked there, worked there, day in, day out, in their 1000’s.

Yes, we can do much much better in Australia, to look after our needy. But we are, in the main, very, very lucky. Most of us, myself included, live charmed lives in comparison to a good couple of billion people on this planet.

We should remember that.

Having travelled extensively, I agree that we live in a wonderful country. I am a pensioner now, but own my home and car so have a comfortable life. However, I can’t seem to enjoy my good fortune with contentment, knowing there are so many fellow Australians struggling. We can and should be doing better. I’m reading a book called “Trillion dollar baby” showing how “a few good men” in Norway created a huge future wealth fund for all of it’s citizens. Unlike so many other countries, including Australia, having mind that their oil and gas was a finite resource, they made a tough bargain with the resource companies. Now Norwegians have many billions invested to benefit current and future generations. The horse has bolted on that for us, but a windfall profits tax now and a reduction of subsidies could help with a little wealth distribution.

Spot on diseyoats, I also read “Trillion Dollar Baby”.

It highlights what we could have had in Australia 50 years ago, if Connor & Whitlam had not had to run the gauntlet of bloody minded obstruction from powerful vested interests to their proposed Petroleum & Minerals Authority.

Like Statoil, the income generated would have undoubtedly fed into a Sovereign Wealth Fund like Norway’s.

Rather than choosing, like Norway, to be the masters in developing our finite petroleum & mineral resources, we effectively abdicated to

become servants to foreign interests & corporations.

Paying the price today, with precious little to show for it.

It takes quite a bit of money to consume enough drugs/alcohol to become addicted.

Imagine if they’d spent more wisely.

Of course, that would require personal responsibility which seems to be anathema to the victim seeker brigade .

I know what you are saying Dounreay but my experience in life tells me that some, and I emphasize some, people seem to lack the innate ability to take responsibility for their addictive behavior. Mental illness is often part of the equation here too. Expecting those with a mental deficiency to always behave rationally and responsibly is, in a way, tantamount to expecting someone with a broken leg to run laps at the running track. It is not realistic.

So society must be ordered to protect a minority of people from themselves, to the great disadvantage of the majority?

Anyone who thinks that some drugs are illegal because they are harmful has no life experience or deliberately morally myopic.

Re your ‘broken leg’ metaphor, I recommend Kurt Vonnegut’s “Welcome to the Monkey House”.

Someone’s mistyped my BSB and account details because none of the dollars are in my account. 🙂