The media has been full of coverage about Magellan Financial Group co-founder Hamish Douglass ever since his struggling funds management company released this statement on December 8 confirming he has been separated from his wife Alexandra for several months.

The move coincided with the shock resignation of CEO Brett Cairns for “personal reasons” two days earlier and was followed by a trading halt before Magellan announced it had lost its biggest client when St James Place withdraw almost $20 billion in funds. This disclosure alone triggered an additional 33% rout in the share price last Monday.

The Magellan coverage has ranged from tabloid probes by The Daily Mail to long features in the business pages looking at the business implications, but Douglass is clearly bitter about the attention, telling the AFR this week: “There’s a time when people should really stay out of people’s personal lives,” he said, slamming “some of the stuff in the newspapers”.

The former billionaire is being way too sensitive here considering all the circumstances, including the poor governance structures at Magellan.

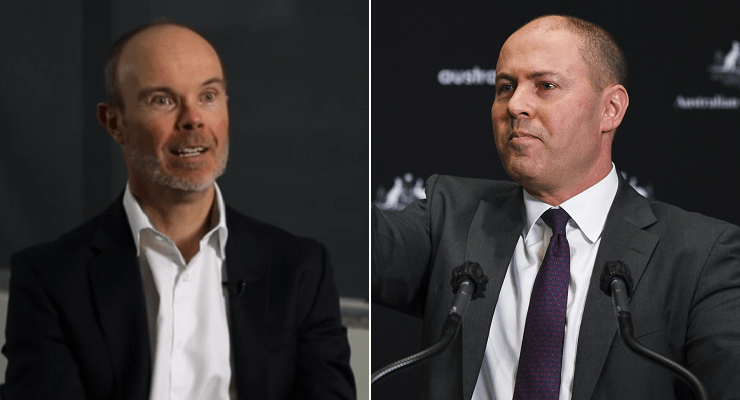

The Magellan situation is relevant as institutional investors grapple with the proposed Josh Frydenberg kneecapping of the proxy advisory industry.

The proxy advisers have long been warning institutional clients against the one man band hero-worshipping set-up at Magellan, where one bloke is the largest shareholder, executive chairman and chief investment officer.

This same dominating figure presides over a company where all of the non-executive directors have taken out full-recourse loans from the company to buy shares, which are now under water after the stock plunged from more than $70 early last year to below $20 this week.

If any of the directors quit, Magellan could force them to repay their loans in full, a set-up which is poor governance because it works like a good behaviour bond.

Rather than practicing poor governance, Magellan should be leveraging the power of its $114 billion portfolio (before the $20 billion departure of St James Place on Monday) to drive for greater transparency in the companies it invests in.

The thing we really don’t know at the moment is the state of the founder’s mind, but it is absolutely clear that he needs to be replaced as chairman by one of the existing directors or, preferably, a respected cleanskin outsider such as David Gonski.

Douglass owns a 12% stake in Magellan, so it is not really material if his former wife suddenly wanted to sell a 6% stake, besides confirming that he’s well and truly in the “former billionaire” club.

The Australian’s 2021 Rich List valued his wealth at $1.49 billion and the AFR put it at $1.23 billion, whereas after the 70% tumble from top to bottom, his 22.2 million Magellan shares are now only worth around $440 million.

Apart from the governance and confidence issues, the biggest problem at Magellan is under-performance, primarily related to last year’s decision to move decisively into cash near the bottom of the COVID-related market meltdown. This was a dreadful call which has cost clients several billion dollars and won’t ever be retrieved because most of that surplus cash is now being returned to St James Place.

This is a situation where these five independent directors, encouraged by the proxy advisers and key institutional shareholders, need to step up and stabilise the Magellan ship, which is listing badly.

Instead, the proxy advisers are currently consumed by the extraordinary decision of Frydenberg last Friday to propose new regulations which cancel all of their ASIC licences with just 52 days notice.

US-based ISS is the world’s biggest and most powerful proxy adviser and its Australian boss, Vas Kolesnikoff, described the proposed changes as “an embarrassment to Australia that not even the Trump administration pursued”. The AFR’s “Chanticleer” columnist James Thomson agrees, slamming the package as “a shocker”.

If Hamish Douglass wants to rebuild some credibility, he could start by calling for the government to ditch its mad proposals, which involves fines of $1.3 million for individuals working at proxy firms which don’t email their reports to public companies at the same time as they go to their paying institutional clients.

Imagine if individual journalists were fined by the government for not emailing stories to politicians at the same time as they go to paying subscribers. This proposal is no different to that. It’s about time News Corp journalists joined the campaign to stop the Coalition attack on proxy advisers, even though they have long criticised the governance arrangements employed by the Murdoch family and other billionaires such as Gerry Harvey and Solomon Lew.

Crikey is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while we review, but we’re working as fast as we can to keep the conversation rolling.

The Crikey comment section is members-only content. Please subscribe to leave a comment.

The Crikey comment section is members-only content. Please login to leave a comment.