While Russia’s oligarchs are rushing around hiding their superyachts in sanction-free ports, Australia’s 250 rich listers are quietly enjoying the lazy half-billion each they’ve added to take their average wealth up by one-third through the COVID pandemic.

Thanks to News Corp’s annual wealth-porn supplement — the Rich List inserted in The Australian last Friday — we can see just how well they’ve been doing.

Looks like Australia’s 1-in-100,000 billionaires and multibillionaires — the 0.001% — have seen their combined wealth climb to about 27% of GDP while most of us were busy trying to keep safe, working from home and getting vaccinated.

The list identifies 133 Australian dollar billionaires (or 99 in the more global US dollar measure).

Some are not quiet about it. Take Clive Palmer (please — boom, tish!): he’s seen his net wealth almost double in the past year alone from an estimated $9.76 to $18.35 — that’s billion. No wonder he can afford to throw a bit of tax-deductible largesse in the direction of old media courtesy of those ugly yellow strip ads for the United Australia Party. Guess every self-respecting billionaire is entitled to their own political party.

It’s not all good news for the well-heeled, however. Perennial list-topper Gina Rinehart has seen her wealth drop from $36.28 billion last year to just $32.64 billion this year. The wealth of each of her four children (39-42 on the list) has also slid. But don’t fret. Last year was up almost double, so they’re all doing OK.

The family owners of this rich list are doing OK, too, largely off the passive holding of Disney shares they exchanged for 20th Century Fox in 2019.

News Corp co-chair Lachlan Murdoch, who spent last year’s Delta outbreak working from home in Sydney, is at No. 22 on the list with assets of $3.82 billion, up about $200 million on last year. His sister, Prudence MacLeod, is No. 43 with $2.46 billion.

Their father Rupert is considered insufficiently Australian to make the list, but take this as your annual reminder that, based on global numbers from Forbes, one in 400 of the world’s 2750-odd billionaires is a Murdoch.

Fellow media oligarch Kerry Stokes, executive chair of Seven Group, is also up, with his $7.46 billion positioning him at 13 on the list. You can fund a lot of defamation action with that money.

Meanwhile, former media oligarch James Packer is also doing well out of the quiet life, recouping the $200 million that his wealth fell in 2020. This year’s $4.2 billion puts him at No. 21, just ahead of his former One.Tel partner Lachlan Murdoch.

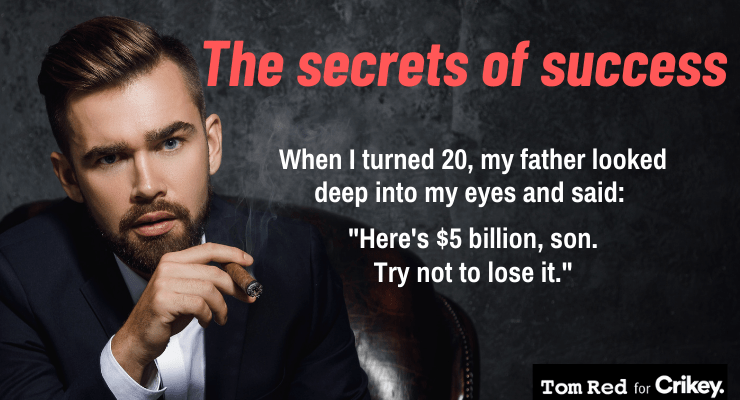

Although the list indicates that the fastest route to the billionaire class is to be born into it, the copy around the list highlights Australia’s emerging tech class, like the founders of Australia’s very own unicorns (billion-dollar tech companies) Canva and Atlassian. Their wealth has all soared off the COVID tech boom, although the sector has gone backwards in the past month.

Rich lists are a product of the gaudily boastful 1980s, as it suddenly became socially acceptable to talk — brag even — about money (sparking the Donald Trump phenomenon, among other things).

Fairfax’s Business Review Weekly took the idea from Forbes with a richest 200 (now continued in the AFR) and found it a surprisingly strong money maker. The Australian launched its more-inflated richest 250 in competition in the 1990s. They still make money through advertising, subscriptions and the branding they deliver the mastheads.

But now the business model — monetising money porn — is at odds with the journalistic imperative: reporting the rise of the billionaire oligarch class. Rather than providing aspiration models, it reveals the hard truths of inequality driven by birth, gender and race.

Australia’s COVID experience demonstrates what French economist and writer Thomas Piketty said: because the return on wealth is greater than the growth of the economy, the take of the rich grows.

The result? Less for everyone else. In Australia right now, that’s being delivered courtesy of stagnant wages.

Crikey is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while we review, but we’re working as fast as we can to keep the conversation rolling.

The Crikey comment section is members-only content. Please subscribe to leave a comment.

The Crikey comment section is members-only content. Please login to leave a comment.