Treasurer Jim Chalmers could use some cash right about now.

He has inherited a sizeable budget deficit with rising interest rates — and that’s before he’s paid for Labor’s promises or cleaned up sectors Morrison neglected. Last week’s economic update showed increasing tax receipts. But with recessionary storm clouds on the global horizon, that might not last long.

How should he plug the fiscal hole? I never thought I would say this, but he should look to the fine example set by former prime minister Tony Abbott.

Tony Abbott: class warrior?

Don’t get me wrong — Tony was probably Australia’s least successful political leader ever, with a legacy more instructive to satirists than serious policymakers.

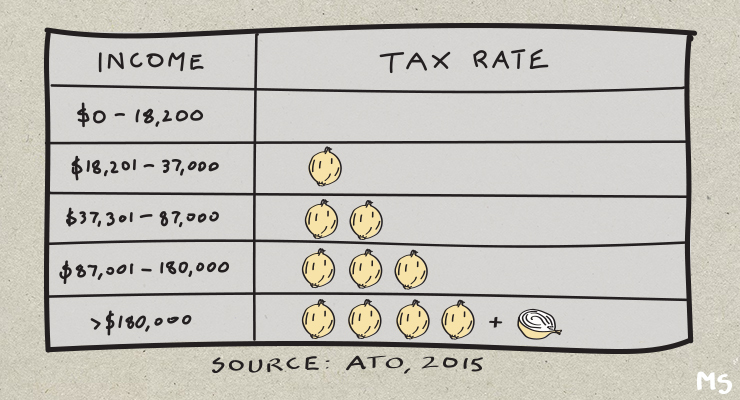

But he did have one good idea we should revisit: the temporary budget repair levy. It applied an extra 2% of income tax to earnings more than $180,000 — like a second Medicare levy for the wealthy.

It was intended to spread the burden of his government’s austerity, to ward off criticism that it was leaning too heavily on the lower and middle classes. It was a piecemeal offering amid savage budget cuts, but we nonetheless witnessed our most right-leaning prime minister since Menzies raise taxes on the rich — a surprising fact that the left is yet to fully exploit.

The Turnbull government allowed the three-year levy to lapse in 2017. With the budget now in much worse shape, it’s time to bring it back.

Bring back Tony’s tax

Former opposition leader Bill Shorten vowed to keep the levy in place for at least 10 years if he became PM. But since Albanese took over, Labor went quiet on the proposal in keeping with his “small target” strategy. Asked by the Nine papers on the campaign trail whether he’d reintroduce it, Albanese said no.

Labor also backflipped on the Coalition’s proposed tax cuts — whereas Bill Shorten had proposed to just match and extend lower-income cuts, Albanese agreed to those for higher earners too. This opens a significant hole in the government’s revenue from 2024, in the least equitable way, adding to its current fiscal woes and entrenching inequality.

However desirable, reversing course on the “stage three” cuts now would be admittedly controversial for Labor. Accusations of lying to the electorate would be fierce and damaging.

However, Albanese would lose much less skin from reversing course on the deficit levy. It hardly featured in the election campaign and is narrower in scope, affecting fewer people. He’d be in a stronger position to say, “The books are worse than we thought, so something has to give”. It would also be harder for the opposition to argue against.

Making the richest give back

Australia is a low-taxing country, and that would hardly change if we raised the top tax bracket. Only approximately the top 4% of earners would be impacted.

For those on high-but-not-astronomical incomes (let’s say they’re a federal MP, and thus earn $217,060 per year), it would merely claw back a small fraction of their upcoming savings from the 2024 tax cuts. They’d hardly notice the small hike on their top tax bracket amid the larger lowering of their middle brackets.

The levy’s real importance would be for the very rich. Taxing their earnings above $200,000 at 47% (instead of 45% currently) would compensate for the lower amount of tax they’ll pay on their first $200,000 from 2024. For the obscenely rich, it would overcompensate and see them paying more overall.

This would not fix Australia’s revenue problem alone — for that we’d need broader taxes on, for instance, capital assets. Nor is it preferable to stopping the “stage three” tax cuts altogether. But it presents a politically viable pathway to ameliorating the worst excesses of our future tax code, which without modification will be extremely inequitable and fiscally reckless.

Chalmers admires Keating for administering harsh but necessary economic medicine. In following suit, and in the unlikely footsteps of a less-esteemed former PM, it’s time for him to shirtfront the rich.

Crikey is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while we review, but we’re working as fast as we can to keep the conversation rolling.

The Crikey comment section is members-only content. Please subscribe to leave a comment.

The Crikey comment section is members-only content. Please login to leave a comment.